James is back! And he’s got stuff to say!

For legibility, I will make his replies into a guest blog-post (my first, Yayyy!) with a bit of structuring thrown in.

This is a lengthy post and it will not always be easy to follow if you've not read the previous blog-posts. So do read those first.

I will reply (of course) but in another blog-post where I will summarise our main differences and try to answer them so that other readers may get an holistic view of the discussion.

1- James’ initial comment: You’re right that many people are shockingly ill-informed about the candidates and policies they’re voting for, but this is true across the spectrum of political opinion.

Fred: I'll concede that point. I've seen the tape on Obama voters and it was indeed embarrassing. Basically, people start with the assumption that whatever their man/their side say is correct/good and go from there.

What I was trying to focus on or express was that US Republicans, with the Ryan Plan and their obsession with cutting tax on the wealthy seem to be lying through their teeth. But maybe I am wrong and you're right and the politicians sincerely believe that "tax cuts pay for themselves" and 'trickle-down' economics, even if most of their own economists and advisers don't.

James’ response: For the sake of argument, I’m willing to accept your premise that no tax cut can ever be revenue-neutral. However, as I've said, if this is a lie then it’s also one which left-wing politicians are guilty of on the (admittedly, rarer) occasions when they wish to lower taxes.

For example, this is a claim which Ed Balls (the Labour Party’s Shadow Chancellor) has made when campaigning for a cut in the basic rate of income tax:

The point that I was making is that (as a rule), politicians of any party will make whatever claims they feel that they need to in order to get elected.

For someone proposing a tax cut, claiming that it will be revenue neutral is presumably expedient because it allows them to dodge awkward questions about how they’re going to pay for it.

The politicians in question are presumably gambling on the fact that economics is a sufficiently arcane subject that few of us will have the patience to follow a debate over whether the predictions which support the revenue-neutrality of said tax cuts are reasonable.

2- James’ initial comment: I was aware that Republican states receive more money from the federal government than Democratic ones. However, I don’t think that this is relevant to the arguments for and against progressive taxation.

Fred: ???! I'd say that's strongly making the point that Republican voters are squarely shooting themselves in the foot. Why are they doing so? Either because they're unaware of what they're voting for (my belief) or because they have a dedication to the public good as they see it that supercede their own self-interest (what you're saying, if I understood you?). I just find the second proposition unlikely. As you said, "people react to incentives"...

James' response: Republican voters would only be shooting themselves in the foot if they stood to pay more from a less progressive system of taxation. The fact that Republican states receive more in federal aid than Democratic states doesn’t, of itself, support this proposition (and more on that later...).

On the contrary, Republican voters tend to earn more than Democrats, and might therefore be reasonably expected to pay more in tax.

Take a look at the 2012 Presidential Election, and you’ll see that voters with annual incomes of less than $30,000 broke 63%/35% for Obama. Conversely, voters with an annual income of more than $100,000 split 54%/44% for Romney.

The popular stereotype that the average Republican voter is someone living in a trailer park is clearly inaccurate.

Look back over the last few elections, and you’ll see that is anything but a one-off aberration. In every recent election, voters in the lowest income groups have voted overwhelmingly for the Democrats, while the Republicans consistently do best among the highest income groups (i.e. Republicans’ support for moves towards a flat-rate system of taxation are no less rational and self-interested than is Democrats’ opposition to them.)

3- James' comment: I think that Romney’s broader point was correct: people who receive government benefits without paying anything back in tax don’t have much reason to care about government efficiency or whether the tax burden is tolerable.

Fred: The funny thing is that people care about taxes even if it doesn't affect them. For example, in France, a socialistic country if there ever was one, 80% or so of people approved of a Sarkozy law reducing inheritance taxes. That's despite the fact that most economists hated that reduction (inheritance taxes are often seen as 'economically efficient') and, the cherry on the top, 80% of French weren't going to benefit from that tax cut because they were below the previous threshold for inheritance tax anyhow. Basically, it was a 80% approved gift from the 80% poorest French to the richest 20%.

And that's, in my opinion, why you get tax-exempted SS pensioners depending on Medicaid to vociferously criticise any tax raise on the richest...

It may make no logical sense but most people just hate taxes with a passion beyond reason. And not just the taxes affecting them.

James' response: This is presumably only something which could be described as a “gift” if your premise was that everything the rich own is somehow illegitimate, and rightfully belongs to the government. Otherwise, it would be more fairly characterised as saying “we’re going to overcharge you slightly less, relative to the cost of the services which you use.”

That said, you’re right that people often support policies from which they will derive no immediate benefit. I suspect that this is, in part, because most of us are (however irrationally) optimistic about the future, and have aspirations to increase our wealth as our careers progress.

Furthermore, as you've acknowledged elsewhere, most of us are also broadly willing to acknowledge that the rich have the same right to enjoy their property as we do to enjoy our own. (What can I say, Fred, you've restored my faith in human nature…)

4- James' initial comment: To address the specifics of the example you raised: Romney’s 47% comment was extremely ill-judged, not least because his 47% included groups (such as retired people) who make up some of his party’s staunchest supporters. (As you say, retired people are an obvious exception: as they've generally made up their minds as to which party they’re going to support far earlier in life. The other obvious distinction is that most retired people have paid for whatever perks they enjoy in old age through a lifetime of taxes.)

However, I think that Romney’s broader point was correct: people who receive government benefits without paying anything back in tax don’t have much reason to care about government efficiency or whether the tax burden is tolerable.

This can be a dangerous thing, as it risks creating a group of voters for whom the welfare state is an endless free lunch, and for whom taxes are something which only happen to other people.

Fred: But these people still actually pay taxes, if not income taxes. They pay VAT and they pay payroll taxes. They pay local (and, in the USA, state) taxes. They pay duties and fees. Don't worry, they pay. And these are the most regressive taxes around. Overall, the steeply progressive income tax compensate for the regressive nature of all the other taxes to provide a "mildly" progressive tax system (in the USA at least but I doubt the UK is very different).

James' response: You are, of course, right that most (but not all) of these individuals will be subject to other forms of taxation. As I said, Romney’s comment was ill-judged.

However, I think that the fundamental problem which he identified is correct: the current tax system has created a situation in which the classes of voters who benefit most from government spending have no reason to care whether the tax burden is tolerable.

The fact that 47% of the American electorate has been exempted from paying income tax is itself problematic, because income tax receipts are far and away the largest source of tax revenue which the US federal government receives:

Furthermore, of the 47% of Americans who do not pay income tax, 33% are also exempt from payroll taxes (i.e. they have no reason whatsoever to care whether the tax burden imposed by the Federal government is tolerable).

Now, of course, this is only a problem if you want such people to have a reason to care about the rate of taxation. As a socialist, you might find it more expedient not to, as this sort of arrangement provides left-wing parties with a constituency who can be encouraged to view the state as a source of endless free stuff at other people’s expense. However, you might forgive the middle class taxpayers who are forced to foot the resulting bill if they find this inimical to their interests.

If you want to talk about VAT (which would bring our discussion back to a UK context), I understand that there is a degree of controversy over whether it should be counted as a regressive tax. The IFS have suggested that it would be more reasonable to consider its impact as a percentage of net expenditure, rather than of income, which would make it another progressive tax:

[NB: I can't re-paste the graph. Please go to the PDF linked below for the graph itself]

5- James' initial comment: These people certainly aren’t representative of the broader socialist movement. However, I suspect that such people generally vote overwhelmingly in favour of socialist parties as a means to the end of securing an ever-increasing stream of government entitlements. In this sense, they are a constituency which the left has manufactured for itself (at the taxpayer’s expense), who can be relied upon to lend the weight of their votes to its ideological agenda.

Fred: This is an oft-repeated claim but it has relatively little empirical support. As we've established above, people who most benefit from the federal government are Red States and voters within. You cannot claim simultaneously that left-wing voters just follow their interests and vote themselves entitlements while the fact that, in some cases at least, it is right wing voters who benefit most from said entitlements is actually irrelevant to the discussion...

James' response: As above, you’re right that Republican states tend to receive more in federal aid than their Democratic counterparts. This is irrelevant, as the overwhelming majority of the individuals who actually receive these benefits vote Democrat.

I’m going to link you to Tino Sanandaji’s blog “Super-Economy” to provide more detail on this: ‘Paul Krugman is in puzzlement, having observed that Red States get more welfare funding, while Republican voters oppose the welfare state. He portrays Republicans as “Moochers” who are either hypocritical or too stupid to know their own best interest.

But as we know, states do not vote, individuals do. There is only a paradox if Republican voters receive welfare at above average rates while voting against it. From the Gellman-paradox we know that the low-income voters who drag down the Red States average tend to vote disproportionally for Democrats. Republican voters earn significantly more than Democrats, even though Red states earn less than Blue states.’

Sanandaji goes on to provide some opinion poll statistics:

· 72% of all long-term unemployed voters vote Democrat.

· Voters who received any form of welfare assistance from the government split 63%/22% between the Democrats and Republicans.

· Voters who received government subsidized housing split 81%/12%

· Voters who received Medicaid split 74%/16%.

· Voters who received food stamps split 67%/20%.

· Voters who received unemployment compensation split 66%/21%.

Take this along with the above data on income, and you’ll see that the overwhelming majority of the people who receive welfare payments vote Democrat, while the people who shoulder the lion’s share of the tax burden to pay for said entitlements tend to vote Republican.

Without being too dogmatic about this, the most natural explanation is that both groups are voting according to what they perceive to be their own economic interests. Welfare recipients therefore tend to support the party which can be relied upon to keep their benefits cheques increasing at the most generous rate possible. Meanwhile, more prosperous voters, who pay most of the taxes but derive comparatively little benefit from the welfare state, tend to cast their votes for the party which promises to lower taxes and wean people off of welfare dependency.

Where this might get more interesting is if we consider the small minority of welfare recipients who vote Republican (and their opposite numbers: wealthy Democrats). My suspicion is that such individuals are voting on cultural or social issues.

6- James' initial comment: The analogy that sprang to my mind while I was writing this was of a group of friends going for a meal:

Bob: “We’re going for a pizza, do you want to join us?”

Joe: “Sorry, I can’t afford that.”

Bob: “Don’t worry, we’ll cover your share.”

Joe: “Okay then, I want to go to Papa John’s.”

Bob: “You know that’s an hour out of our way, right?”

Joe: “Oh, and I want an extra-large with a stuffed crust and extra toppings. And while you’re down there get me two six-packs of beer and a bottle of whiskey.”

You might feel that the comparison is unfair, but I’d say that’s more or less where this woman is now (i.e. milking the benefits system for everything she can get out of it):

http://www.telegraph.co.uk/news/uknews/9880720/Unemployed-mother-of-11-is-keeping-horse.html

http://www.telegraph.co.uk/news/uknews/9880720/Unemployed-mother-of-11-is-keeping-horse.html

Fred: I had seen that story when it appeared. And, yes, this is a case of abuse and she certainly isn't the only one. But I think we should still keep things in proportion.

First, how much do we spend on social programs for the non-working poor? It's not that simple to calculate but some people did the maths.

Basically, 5% of the federal budget go to non-working poor ($235 billions). Even if every single one of them was a sponge and a feckless cheater, it's still a relatively small percentage of federal expenditure. And it's roughly the money the federal government get from corporate income taxes, by the way...

James' response: You could have applied the same argument to the MPs’ expenses scandal (“the sums involved are minuscule as a percentage of overall government expenditure… what are you all getting so worked up about?”)

Such an approach isn’t necessarily unreasonable. However, I suspect that most taxpayers will object to any abuse of public money, however small the sums involved might be. Our government accountability arrangements certainly reflect this understanding (i.e. audits of government bodies in the UK consider the regularity of government expenditure along with the standard accounting assertions).

And let’s be honest about this: a welfare system which can be milked to allow someone who has never worked to make more than £45,000 a year (which is equivalent to a salary of £66,000, as she won’t be paying income tax or NIC) is fundamentally broken and desperately in need of reform.

In fact, the Labour Party might have been prudent to have corrected some of the most flagrant abuses when they were in power, to undermine popular support for the more wholesale reforms which we are seeing now.

Fred: In general, though I think this is an interesting point. Part of the appeal for conservatism's economic policies seem, to me, based on the fact that people truly hate 'spongers' like that woman, far more than they resent corporate tax dodgers or white collar criminals.

I am not sure why this is the case as I am the opposite way - Personally, the undeserving rich get on my nerves far more than the undeserving poor because I think the amounts involved and the seriousness of the consequences of these 'abnormalities' don't even begin to compare.

James' response: You’re conflating two very different things. No one’s arguing that white collar criminals should go unpunished: if they are convicted of a crime then they should be sentenced and punished accordingly.

However, you seem to be proposing something considerably more drastic, namely dispossessing the richest members of society and collectivising their wealth.

I’m aware that your argument is that shareholders are no less parasitic in recovering a return on their investments from companies’ profits than people like Heather Frost are in milking the benefits system. This was, incidentally, also one of Lenin’s beliefs.

However, as you say, this isn't something which is going to hold much water for anyone who isn't already choosing to view the world through a lens of socialist dogma. We don’t share in the ideological beliefs which have led you to conclude that this would be a productive or a desirable outcome.

You might see a visceral reaction to particular new stories (“bloody bankers are at it again…”), or twinges of envy at reports of executives’ bonuses, but this isn't something which will readily translate into political radicalism.

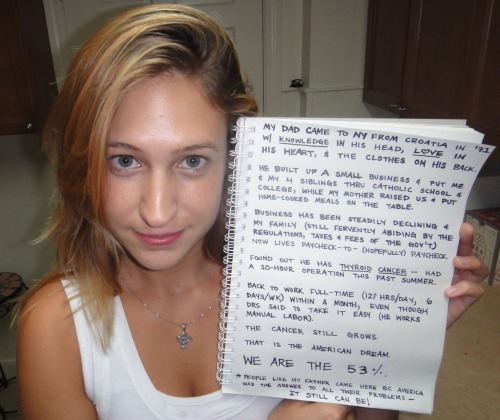

7- James' initial comment: For a hopefully interesting tangent, which might also help to answer your point about why some people on lower incomes support right-wing policies, you might like to check out “we are the 53%”:

The common theme between many of those posts is people who are (or have been poor) but who don’t want government hand-outs and are determined to make their own way in life on their own merits. I think that this shows that there is still a strong current of individual self-reliance in the US (which doesn’t exist in the same way here in Britain). For what it’s worth, I suspect that most of those people are going to be very successful in achieving their ambitions.

Fred: Yes, I had actually read some of them when they first came out. And I took away a very very different lesson from them than you did. My reaction was best summarised by a Forbes article: "The 'We are the 53%' Tumblr is Heartbreaking".

To wit: "For one thing, most of the fifty-three-percenters are probably not actually in the 53%. Many describe a life of hardship, unemployment or underemployment, and dependence on government jobs and services.

James' response: How many of the fifty-three-percenters actually raise those issues? You might choose to interpret them into their posts, but there isn't anything on the Tumblr itself to support this.

What most of them actually talk about is working long hours to establish their careers and provide for their families. This is surely the opposite of underemployment.

Fred: (...) After this young woman’s father was diagnosed with thyroid cancer, he was told by the doctor to take it easy since he’s a manual laborer. Yet he went back to work full-time, working 12 hours a day, six days a week. She writes, “The cancer still grows. That is the American dream.”

The notion that this is the American dream, that men diagnosed with a horrible cancer should work 72 hours a week to support their families, is deeply tragic. There ought to be better visions of society than this."

James' response: The above narrative from the Forbes article is misleading. This is the fifty-three-percenter in question, who us that her father is a self-employed small businessman whose work involves some manual labour (i.e. he isn’t a manual labourer, as the Forbes article claims):

My understanding of the US welfare system (and I’m not too proud to admit that I had to Google this before responding to your point) is that self-employed workers often choose to opt-out of the government insurance fund which would entitle them to receive unemployment benefits.

Now, I completely agree with you that this is a very flawed system, and one which seems to be failing a lot of small business owners (as the government seems to be setting said insurance contributions at a level which many of them struggle to pay). People who are working, and presumably paying taxes, deserve a safety net to fall back on when things go wrong. But this is a government failure, and not a crisis of capitalism.

Moreover, the Forbes article is wrong in attempting to use her story to debunk the 53% movement, because it’s a very unrepresentative example. This issue isn't common to the other posts there, which tend to be considerably more positive.

Fred: Inter-generational mobility is down in the US and in the UK i.e. people born poor stay poor.

James' response: You've told me that you believe in statistics, so let’s deconstruct this one:

In the US, 38% of people who are born to families in the lowest income quartile remain there themselves (http://checchi.economia.unimi.it/pdf/8.pdf). The remaining 62% move up into higher income groups (12% make it into the first quartile, 24% into the second and 26% into the third).

So, if we were to begin from the premise that the fifty-three-percenters were typical members of the lowest income quartile then we would therefore expect to see most (62%) of them succeeding in improving their material circumstances, relative to the rest of the US population.

However, these things obviously aren't decided at random, so let’s drill down a little deeper. Two of the biggest co-determinants of poverty in the US are:

(1) Having a criminal record; and

(2) Leaving school without any formal qualifications.

In other words, substantial numbers of young people sabotage their own futures by committing crimes and by slacking off from (or dropping out of) school. As you've suggested, these are problems which can be more prevalent in impoverished areas, because the people there often choose to buy into a culture of believing that hard work doesn't pay, and instead seek immediate gratification (or the chance to make a quick buck) through criminality.

On the debit side of the equation (let’s call them contingent assets…), we have people like the “we are the 53%” movement, who are (if we take them at their word) firmly invested in their own futures, hard-working, ambitious and fiercely independent.

Whatever disadvantages these people might face, their approach seems fundamentally the right one and they might reasonably be expected to achieve more by working hard and taking ownership of their lives than they would by buying into the welfare culture of dependency and entitlement. These are the sort of people who can be expected to beat the curve (i.e. more than 62% of them will succeed in improving their material circumstances).

We could contrast these individuals with the “99%” movement who, in accordance with their socialist ideology, sought to bring about change on a societal rather than an individual level. To my knowledge, they've achieved nothing more than doing considerably property damage, squandering government money in policing their demonstrations and (in several cases) acquiring criminal records.

Fred: This is the anti-thesis of The American Dream and against conservative's ethics and their supposed objective of making hard work pay. This is the opposite of meritocracy, a value shared both by liberals and conservatives.

James' response: The American Dream is an old idea, and one which has meant very different things to different people, but I’m not sure that it’s ever been about equality in the socialist sense. It’s more the idea that people should be free to seek prosperity without being told to “know their place”.

As for meritocracy, it’s undoubtedly true that it can be harder for people from impoverished backgrounds to succeed than it is for people with middle-class or wealthy parents. Is this the opposite of meritocracy? Not as I would understand it. (Please bear with me a moment, and you’ll hopefully see that this isn’t a fatuous answer).

It’s natural and inevitable that parents will try to give their children every possible advantage in life. Children who are born into middle-class households will generally have an enormous advantage in that their parents are often more able to invest in their futures, and will push them to succeed in every aspect of their lives.

Middle-class children are still more likely to have a stable home life than those born into poverty. (Check out the link I sent you about Coming Apart and you’ll see that the process of familial breakdown which began in the sixties has disproportionately affected America’s poorest communities, while the professional classes are comparatively untouched).

As you have said, the middle-classes are heavily invested in their children’s education. If their children’s grades slip then they want to know why (and will be willing to either invest their own time, or hire a tutor, to put the matter right). If their children play truant from school then the parents will take them to task for it.

Children take a lot of cues from their parents. Parents who are avid readers are likely to instill a love of reading in their children from an early age. Parents who are highly articulate are likely to pass on some of their range of vocabulary to their children. No less importantly, we also equip our children with the aspirations and values which will enable them to make a success of their professional lives.

And, of course, middle-class parents are able to continue providing their children with financial support in their last couple of years at school, and at university.

Children who are born into poverty are less likely to have these advantages. That isn't to say that their parents won’t love them and want what’s best for them, but rather that they’ll be less likely to have the skills and life experiences which would enable them to provide their children with the same sense of direction. Furthermore, many of the lessons which they may have gleaned from their own life experiences to pass on to their children, while sincerely held, will be counter-productive (e.g. not valuing education). And this is, of course, before we delve into the murkier waters of parents who live in poverty because they are addicts, criminals or suffer from serious mental health problems.

So, does this mean that meritocracy is a pipe dream? My answer would be “no”, for two reasons:

1- Because the end result of all of this investment will mean that those middle-class children who do succeed will often have developed skills and abilities (the “merits” on which said meritocracy is to be based) which many of those born into poverty will not. For example, we could reasonably expect them to be more highly literate, articulate and numerate: these are all attributes which employers are likely to value; and

2- Because significant numbers of people who are born into poverty have the force of character to overcome these disadvantages and to claw their way up into the middle-classes (or, indeed, into affluence). In other words, these disadvantages are far from insurmountable and people who are born into poverty are still very capable of succeeding on their own merits.

Left-leaning governments can, and often do, legislate away the benefits which middle-class children can derive from these advantages by setting quotas or by imposing lower thresholds for applicants from disadvantaged backgrounds. For example, the Blair government sought to force universities to accept state school pupils with lower grades than those from private schools. But this has nothing to do with meritocracy: it’s a form of social engineering which seeks to promote social mobility for its own sake, at the expense of forcing employers or universities to discriminate against the candidates best suited for a vacancy in favour of less capable applicants. (And, of course, which rewards said left-wing parties’ core supporters at the expense of groups which tend to vote for conservative parties.)

To my mind, the antithesis of a meritocracy would be either a feudal system, in which there was legislation prohibiting certain classes of people from performing particular jobs, or an egalitarian one in which the notion of succeeding or failing on one’s individual merits was meaningless because the government imposed punitive rates of taxation to deny those who had succeeded the fruits of their labours, and redistributed them to those who had not.

Fred: Furthermore, when people are cycling in and out of low paying jobs, you simply cannot separate the working poor and the non-working poor and create distinct 'deserving' and 'undeserving' categories. With insecure temporary work, zero-hours contracts and agency work a reality for millions of people, including so many of these 53% tumblr posters, people move in and out of employment, fast, just as they sometimes move in and out of criminality. There's no 'bad' poor who steal or cheat and 'good' poor who work and starve. It's the same people, most of the time. Some just get caught.

James' response: First of all, I’m not a big fan of talking about people “moving in and out of criminality”, as this removes any inference that the individuals in question can (and should) be held responsible for said criminal actions.

Secondly, none of the “we are the 53%” posters I've read talk about any of the issues you've raised.

Left-wingers often seize on the notion of the “undeserving poor” as a key to understanding (and debunking) conservative viewpoints, presumably because the phrase strikes them as being transgressive and shocking. For example, the Guardian seems to be recycling the phrase “shirkers and strivers” on a weekly basis to outrage their readers.

My $0.02 on the matter is that there are individuals who are temporarily unemployed through no fault of their own, or who might be unable to work due to serious health problems. They clearly “deserve” our support: whether this is to be provided through social security programmes or through private charities.

It’s unfortunate that the British welfare system does such a poor job of supporting such people (e.g. there are benefits available to pay rent, but not mortgage contributions, which means that working people are likely to lose their homes). These individuals are therefore likely to face considerable hardship and uncertainty if they become unemployed, which individuals who have structured their affairs in such a way as to exploit the benefit system will not share.

Conversely, there are people who have become very adroit at milking the benefits system to get what they want without needing to work for it. I have recently seen a number of documentaries about the British welfare system in which teenage girls have spoken very candidly about having become pregnant in order to secure their own homes at the taxpayer’s expense. There is definitely a “welfare culture”.

I suspect that such individuals are ultimately shooting themselves in the foot, not just because they have made their financial security dependent on benefits which are at the mercy of shifting government policy, but also because they have isolated themselves from the opportunities for personal growth, and the web of human interactions, which a job can bring. This isn't to say that they do not deserve our help, but that the best thing the government can do is to refine the benefits system to give them a reason to work and to remove the perverse incentives which have mired them in welfare dependency.

Of course, you’re right that these aren't binary opposites, and that many welfare claimants will fall somewhere between the two extremes. However, I find the left’s narrative to be simplistic and misleading in assuming that all welfare claimants genuinely do want to work, and in starting from the premise that anyone who “needs” state support should receive it. Welfare claimants are very capable of manufacturing new “needs” if doing so will increase the benefits which are available to them. The welfare system needs to be structured in such a way as to ensure that people who can return to work will do so.

8- James' initial comment: I’d be genuinely interested to find out more about what people mean when they say that they view financial stability as a condition of marriage (and, unfortunately, this is a point which the article doesn't explore).

Is this just a case of young people thinking “I’ll get married and have kids in about 10 years, once I've got my career sorted”

Fred: James, we're not talking about people thinking or able to have 'a career'. They are and will remain low income all their lives if we don't change the system fairly radically.

James' response: Okay, let me rephrase this: why would people on lower incomes be any less capable of getting married than members of the middle-classes?

Being married is, of itself, no more expensive than cohabiting with a partner.

This would only make sense if what they mean is that they are able to claim benefits as single people which they would not be able to claim if they married their partners. In which case, the benefits system is at fault.

Fred: Well, you got an interesting summary by no less than the very right wing Heritage foundation. I obviously don't agree with the way they attribute silly ideas to the left but it references this very interesting study. I especially like this tidbit from the Heritage summary:

"Low-income men and women greatly value marriage and aspire to be married. However, they no longer believe it is important to be married before having children. They idealize marriage, viewing it the same way the upper middle class might view a trip to Paris: an event that would be wonderful in the future but is not necessary or important at the present time".

James' response: No disagreement here: there’s no denying that we have seen a process of cultural change which has broken the link between getting married and starting a family.

Charles Murray’s observation on this (which I find to be a pertinent one) is that this process has disproportionately affected the poorest Americans, and that this is because the welfare state has provided them with powerful incentives to have children before they’re ready to support them and not to marry their partners.

This creates a situation, both here and in the US, where women on benefits start having children from a very early age, often by a multitude of men, and where those children grow up in broken homes without fathers they can respect. This isn't in society’s interests, and isn't something which we should be incentivising.

Fred: In general, we've seen this regularly. Socially conservative commentators attributing increased economic hardships to a decadence of social values.

James' response: This isn't my reading of Murray’s thesis: he’s arguing that the welfare state has created the wrong incentives for people living in poverty, not that they’re morally degenerate.

Fred: This thesis probably has some validity (work ethics, thrift and a capacity to project oneself into the future are clearly important) but far less than usually thought: Northern European countries, France, Germany are amongst the most atheistic/agnostic, the least socially conservative countries around. The USA is the most socially conservative, especially those Red States. Yet, it is the USA which is doing less well when it comes to poverty measures and especially it is the Red States which are the worst. Clearly, being socially conservative isn't enough to pull them through.

James' response: Yes, but do the people who are actually on benefits in those Red States actually buy into the conservative mind-set? The evidence seems to be against it.

9- James' initial comment: I don’t agree with your premise that it’s no longer possible for people to better themselves through hard work. I graduated from university during the recession, and that hasn’t been my experience.

Fred: Sure, it's never going to be a 100% thing. Just like your tumblr people. You think they'll do well. I am pretty convinced they'll do badly. But as a group. Of course, some will always be lucky and succeed or radically improve their conditions, just because of the law of large numbers.

James' response: I’m reminded of a quote from the late Baroness Thatcher, “I wasn't lucky, I deserved it”.

As usual, she had the right of it: people who succeed do so by investing their futures in an intelligent way, and not at the whim of abstract forces.

So, in short, I don’t find it productive to dismiss those individuals who do succeed as being statistically irrelevant outliers: this misses the lesson that we’re capable of achieving similar results if we choose to apply ourselves in the same way.

Conversely, we might no less reasonably conclude that the Herculean hours which such people often typically need to work in order to establish themselves aren’t worth the eventual benefits (i.e. we can acknowledge that they deserve the things they’ve earned without feeling called to emulate their achievements). And there’s no shame in that – as long as we don’t allow ourselves to become a burden to others.

For example, one of my cousins is a banker, and is earning more than I do as a chartered accountant, but she regularly works until 2 or 3 in the morning… and that isn't a prospect which appeals to me.

10- James' initial comment: However, you’re right that we are likely to see continued social unrest over the coming years, because people have been led to expect things which might no longer be achievable.

Fred: Right there, I would question why things might no longer be achievable? Have we lost technologies? Gone through a war? Destroyed factories and buildings? No. So why are things no longer achievable?

James' response: What’s the answer that you’re looking for? The obvious response is, of course, because we've just come out a recession.

Taking a broader view, I’d also need to acknowledge that the British economy is suffering from ongoing structural problems, such as an ageing population, high rates of migration which have increased the competition for the sort of starter jobs which might otherwise have been filled by school leavers and (possibly) a decline in our comparative advantage over developing countries in Asia.

11- James' initial comment: I recently watched a television programme (“Free Speech”), in which a panel of politicians and entrepreneurs took questions from an audience of young people in south Wales (many of whom were unemployed).

One of the interesting things that struck me about it was the sense of entitlement which many of the audience displayed in their response to the panel’s answers. No, they weren’t willing to relocate to London to find work (as many people from Eastern Europe have done). And they had no interest in starting their own businesses (as one of the panellists had done when he’d been unemployed after leaving school in the 1980s).

Fred: Well, in all honesty, I don't have much patience for this either, given that I have spent 5 years away from my family for work-related reasons. But I note that being rooted in their communities ought to be approved of by Conservatives. You cannot complain about the atomisation of society on one hand and scowl people who refuse to move too far from their roots on the other.

James' reply: I wasn't aware of any ambiguity about this: conservative commentators have consistently maintained unemployed people should look for work, and if that means relocating then so be it (“get on your bike”).

The notion that someone should spend their entire life rooted to one spot might have been a Medieval idea (although even that’s open to debate), but it certainly isn't a modern conservative one.

Fred: As to starting a business, 75% or so fail within 5 years (In one of my MBA classes, a professor had said '95%' and I remember a French professor saying it was 90% in France - a lower number is not necessarily good, by the way. It means less entrepreneurs/less risk taking - but I cannot find confirmation through a Google search; 75% is the number I can find). Starting a business is not a good way to fight unemployment at the individual's level.

James' response: My point was that these people were complaining about being unemployed, but who weren't willing to do anything to improve their situation. As you say, it’s difficult to have much sympathy with this.

I’d heard the 90% figure from a Business Studies tutor as well, and suspect that it must be a ballpark figure rather than accurate statistic.

However, for the sake of argument, let’s assume that 90% (or 75%) of businesses do close within 5 years. IIRC, most businesses which close don’t do so because they’re unprofitable but for other reasons.

So, the above ballpark figure is going to include plenty of businesses which have been consistently successful in providing their owners with an income, and which will (no less importantly) also have provided valuable experience which can be translated either to future business endeavours or to work as a salaried employee.

Fred: As to your point about "social conservatives would not see Thatcher's decisions as having been in any way contrary to their values", yes, that's the whole problem I am trying to get at here. They took decisions they thought in line with their values and these decisions destroyed a socially conservative biosphere - a pretty adverse result, including from a conservative point of view. So either the values are wrong (not my argument) or the decisions are wrong and the world doesn't work as Thatcher and her conservative advisers thought it does (that's my argument).

To quote Greenspan,"I found a flaw (...) in the model that I perceived is the critical functioning structure that defines how the world works".

James' response: I’d be interested to hear why you regard the Yorkshire miners as a socially conservative biosphere.

They might have been “conservative” in the broader sense of, for example, believing in “traditional” gender roles in a way which was typical of men of their generation (and which modern conservatives of my acquaintance don’t)… but you could make a similar argument for the Taliban. (Would you also criticise George W Bush for having destroyed a socially conservative biosphere in Afghanistan?)

The miners were one of the most radically left-wing elements in British politics, which is why the left are still so bitterly mourning their demise.

Let’s be honest about this, the sort of contradictions you’re talking about exist in every ideology (and are normally meaningless to that ideology’s adherents). You could as easily ask why socialists tend to favour high immigration rates, when these tend to depress wages and inflate housing costs for the poorest members of society. Or why liberals so often support a state which teaches Holocaust denial in schools, and holds deeply retrograde views on the status of women (i.e. Palestine) over one of the middle-east’s few functioning liberal democracies (i.e. Israel).

12- James' initial comment: It strikes me that socialists, like social conservatives, might find themselves increasingly swimming against the tide if the precepts of their ideology are fundamentally at odds with the way in which our society now operates. This would obviously be a long-term cultural trend, rather than something which would happen immediately.

Fred: I think socialist ideals can be adapted for a more atomised society. And, though I have never bothered to think all that much about them, I suspect the same is true for social conservatism.

With regards to socialist ideals, the transition ought to center around the fact that as an independent individual, you can be subject to lots of unique, unforeseeable 'bad stuff'. Serious illness. Unemployment. Bankruptcy. Etc. And, with the disappearance of extended family ties and clannish-like organisations, society is basically an insurance policy where, to avoid selection bias and adverse selection effect, all are required to be insured/participate.

James' response: Yes, but do people actually think that they’re likely to be unemployed in the future? As discussed above, when people are permitted to opt out of paying social security contributions they generally do even if this means that they will then be exempted from the benefits.

Ditto with pensions: there’s an enormous pensions black hole here in the UK, because people prefer to spend every penny they own on their immediate gratification, rather than saving for the future. And old age, unlike unemployment, is something which is guaranteed.

Because, if people don’t think in that way, then as soon as the notion of “social responsibility” goes out of the window then popular support for the welfare state’s likely to dissipate with it. We've seen that in Britain over the last few years, where even the Labour Party and their supporters seem to be turning against the welfare state in its current form: http://www.guardian.co.uk/politics/2013/may/14/labour-voters-poor-study-solidarity.

13- James' comment: I suspect that a disproportionate percentage of all tax revenue is still paid by the top few per cent of the population. This doesn't necessarily mean that they pay a higher percentage of their income in tax, but does mean that they pay a disproportionate percentage of the total amount which HMRC actually receive from each income group in cash terms.

Fred: That's correct, of course. I also don't see it as being relevant. Reasoning ad absurdum, if the top 0.01% had confiscated a 100% of the wealth, they'd be paying a 100% of the taxes. It still wouldn't be A Good Thing (TM) as far as society was concerned. Unless those taxes represented, say, 99% of the wealth and wealth creation was redistributed like that.

James' response: If you’re thinking in terms of rich people “confiscating” wealth then we probably aren't going to see eye-to-eye…

14- James' initial comment: The CPS report is an interesting one because it compares what people in each income group are paying in taxes (in pounds sterling) with the value of the services which they are receiving from the state in return (in pounds sterling). And, to be honest, I think that’s the way we should be looking at it: the top few per cent are (for the most part) already more than pulling their weight

Fred: See above and my ad absurdum reasoning. Sorry but this is definitely not the way to be looking at it. See below as well as to why.

James' response: This might well not be the way to look at it if you’re proselytising in favour of socialism, but I think it raises a valid point.

Let’s consider the case of a Russian (or Middle-Eastern) billionaire living in London. They won’t be paying income tax to the UK government, but they will be paying VAT on everything they buy, and stamp duty and council tax on their homes.

The revenue which the government will receive from those things will far and away eclipse its spending on whatever services it is providing to that person.

Said billionaire will, of course, also be spending prodigious amounts of money on goods and services and pumping money into the London economy. (Although, in the interests of fairness, we should also allow that they’re going to have a distorting effect on the property market).

Now, let’s say that we elected a radically socialist government which (as you have suggested) decided to go after the rich with a vengeance and collectivise everything (or almost everything) that they owned.

Our billionaire is aware that he can enjoy the same lifestyle in any other world-class city, and has no pressing reason to remain in the UK. His natural and obvious reaction will be to jump ship. He’ll take a hit on the sale price of his house (as everyone else will be panic-selling and doing the same) but the rest of his wealth is likely to be held overseas and to be beyond the government’s reach.

The impact of this will be that the UK government will have lost whatever tax revenue they would otherwise have received, and that local businesses will have lost sales revenue. These are both eventualities which they could have avoided if they hadn’t jeopardised what was a pretty good deal in the first place.

Well-paid professionals also leave the country in droves, leading to a brain-drain and a further headache for the British economy.

Meanwhile, our socialist government needs to compensate for its falling tax revenues and, being unwilling to cut services, either increases the national debt or raising income tax for the middle-classes.

The point is that these people have considerable bargaining power precisely because they bring more to a country than they take in return. (This is, for example, why Boris Johnson has pitched London to wealthy French people who are fleeing Francois Hollande’s tax hikes).

15- James' initial comment: Socialists often try to conjure up a sense of class warfare by insisting that the rich are screwing the rest of us over. However, the only conceivable sense in which this could be true is if from a perspective akin to Marx’s “from each according to his ability, to each according to his needs” (i.e. if you insisted on seeing individuals’ wealth as the something which belongs to society as a whole, rather than as their private property).

Fred: So, again, this is a classic issue. I have no problem with the small time entrepreneur or corner shop owner pointing out to his cute little shop or factory and saying "this is mine!". I don't think he's built it all of his own but, by all means, let him enjoy the fruits of his labours. And I am not about to suggest confiscating one person's house or nice car, to "equalise" everyone. But I do think that your local shopkeeper is not on par with Mittal, Abramovich, the Duke of Westminster or Sir Philip Green. See my comments above about the Invisible Hand stopping people from accumulating so much... unless there is a market failure.

I don't see why we should reward rent extraction. That's not hard work. That's maybe a bit of luck mixed with a lot of ruthlessness.

How come that conservatives are so dead-set against spongers but have no problems with corporate welfare and nonexistent inheritance taxes? How is that related to 'hard work' and 'a fair day's wage for a fair day's work'?

James response: I think I've answered that. The only points I’d like to add are that:

1- For property rights to be meaningful, they need to include the right to dispose of said property as the individual sees fit: including transferring it to friends and family members; and

2- Dispossessing everyone above a certain threshold would create a very dangerous precedent. This would be disastrous, not only because of the impact which it would have on investors’ confidence in one’s national economy (which would stifle investment) but also because of the risk that the threshold above which one could expect to be dispossessed would be gradually lowered over time to eliminate all private property. For those reasons, I suspect that even most socialists would vociferously oppose such a move.

16- James' initial comment: I agree with you that the government should do more to stamp out tax evasion, and to simplify the tax code to limit companies’ scope for tax avoidance.

You’re also right that billionaires would be little better off than the rest of us if we were living in a state of total anarchy (i.e. Somalia). (Although it’s worth noting that even failed states such as Somalia have their own hierarchies which are based in part upon inherited wealth, and in part upon individual ability.)

However, this analogy simply doesn't describe the world we’re living in: the choice for multi-national companies and extremely wealthy individuals is not “do we want to invest in a country with a stable government or in a Hobbesian state of nature”, but rather “will we gain most from investing in this country which has a stable government, or in that one which also has a stable government”. Imposing punitive rates of taxation would achieve little more than encourage investors to divest in one’s country (I’ll return to this point in greater detail later…)

Fred: Already answered, Your Honour. There are things a state can do to stop corporations playing them one against the other. If they don't do these things, this will only be a race to the bottom. Ireland is already screwing much of Europe that way. The UK, Luxemburg, Switzerland... We've let it happen. It's time to reverse the tide. The only serious problem is the UK as they are the only country with a military worth something. We can steamroll the rest, if we really have to.

James' response: You've made quite a few references to invading and blockading Ireland and other small European countries: are these serious suggestions? How do you think that would play out, considering that the Irish-American community are every bit as patriotic, and as politically influential, as their Israeli-American counterparts?

“Adopt socialist policies or we’ll invade” also sounds like distinctively Stalinist approach.

17- James' initial comment: The problem with this is that the sort of international co-operation which this plan requires simply doesn't exist

Fred: Very true. But I am not just about 'what's possible'. I am talking about what's economically correct and what's not. If we agreed here that we adopt conservative economic outlook & solutions just because liberal solutions are more correct but too hard to implement, I would be happy. This is a blog about economics, not a realistic politico-economic program.

James' response: Are you willing to accept that “what’s economically correct” needs to include an acknowledgement that “if we do X then the outcome will be Y”?

If a government were to go after the rich with a vengeance then they would simply respond by moving their wealth overseas, and you’d be free to tax 100% of nothing.

Overseas governments would have no reason to co-operate with such a plan, because they’d benefit from an exodus of wealthy and talented people (as the UK, and other European countries, have done from the response to Francois Hollande’s more moderately socialist policies).

18- James' initial comment: You could call this a “race to the bottom”, but it could equally fairly be characterised as the French government having priced itself out of the market.

Fred: I do call it a race to the bottom and it will eventually not be to anyone's advantage. After all, France may have foolishly priced itself out of the market - for a time - but, surely, the French people will realise the errors of their way and go back to groveling for crumbs like the rest of Europe? And the UK is already uncompetitive compared to Ireland or Luxemburg. I think you should campaign to lower corporation taxes further. If 20-24% is great, surely, 10-12% would be even better?

James' response: I certainly wouldn't be opposed to lowering the UK corporation tax rate, if it would encourage companies to invest.

To answer your broader point, if a business lowers their prices then it’s normally because they've calculated that they will win the resulting price war and be able to increase their market share at their competitors’ expense. This isn't a race to the bottom; it’s a case of exploiting relative strength to gain an advantage over one’s competitors.

We have no reason to believe that national governments do not have access to similar advice. More economically liberal countries (such as Ireland) are able to steal a march on the competition by lowering their rate of corporation tax in the knowledge that the French would be burning cars in the streets if their government tried to follow suit.

Moreover, paying corporation tax isn't the main benefit which companies bring to a country: that’s employing people and pumping wealth into the local economy.

I’d be very happy to see an international corporation investing in Britain without paying corporation tax as long as they were willing to create jobs, and to spend money on local goods and services.

Hi Fred,

ReplyDeleteThanks for posting this.

If you’ll permit an addendum to my previous comments, I’d like to sum up my argument:

Your views seem to differ from those of most left-wingers in that you view socialism as a vehicle for advancing middle-class interests. Clearly, you are not alone in this belief: I remember reading an article by a left-wing columnist (it might have been Robert Reich), in which he lamented the left’s failure to persuade the middle-classes that their interests would be best served by siding with the poor against the rich.

To my mind, this is counter-intuitive. The welfare state isn’t designed to serve middle-class interests, but rather to redistribute our wealth: we pay more in tax than we receive in benefits and government services. Our support for it (although we might disagree as to how it should best achieve its goals) is therefore primarily altruistic rather than practical in nature.

I understand that you also believe that the middle-classes are declining, and that we need to collectivise and redistribute the wealth of the richest members of society in order to avoid losing ground.

My take on the matter is that this would be disastrous. Punitive rates of taxation would exacerbate the brain-drain of top performers to countries with less exorbitant tax rates. Multinational corporations and members of the leisured elites would flee abroad, and be eagerly welcomed by foreign governments who would recognise them as net contributors. Radically socialist policies would also risk destroying investor confidence in the British economy. I understand that France is experiencing some of these problems now, although Hollande’s policies are more moderate than those which you envisage.

Moreover, these sort of policies would create a dangerous precedent, and set the government on a slippery slope to the collectivisation of the middle-classes’ own wealth. This is one of the reasons why the middle-classes have historically been so resistant to socialism.

It’s worth remembering that the income tax was itself, introduced as an emergency measure in Britain to pay for the Napoleonic Wars (there’s a possibly apocryphal story that the government sought to expunge all records of it after the event so that their shame wouldn’t be known to future generations). Gladstone seriously considered abolishing it as late as the 1860s. Today, it has become a universally accepted part of our tax system, and has risen to rates which its creators never envisaged.

The natural tendency of any government is towards growth, and once they've sunk their teeth into a new source of tax revenues you'll have a devil of job weaning them off of it.(I understand there’s an Oscar Wilde quote about this: “the bureaucracy is expanding to meet the needs of the expanding bureaucracy”.)

Anyhow, looking forward to your reply to tell me how wrong I am…

Hi, James

ReplyDeleteNo problem, it is I who thank you for having taken such an interest in this discussion.

With regards to the actual content of the disagreement, yes, I will be replying soon-ish and letting you know just how wrong you are, even when you're right! :)