This will be a short post in reply to Noah Smith's latest blog-post about loving (moderate) inflation.

The various advantages he enumerates about moderate inflation are well-known and I don't think anyone seriously contest that inflation helps past borrowers, be they private or public.

But I've got to disagree with him on his supposedly debunking the two inflation 'myths' he sees as the political arguments against inflation.

I'll start with the second one, the least important in my view. Noah insists that inflation does not punish savers because, as soon as inflation is anticipated, interest rates will adjust and savers will get higher rates. That's quite true but it's also playing on words. Inflation does punish past savers, that's the whole point of the advantages he enumerates and Noah actually acknowledges this.

So that one is nothing but trying to obscure the issue.

But the primary argument against inflation, as far as people are concerned, is that, as Noah phrases it, "inflation means I can't buy as much stuff".

Noah's rebuttal is to point out to wage inflation and insist that, actually, nominal wages track inflation, more or less so people aren't really losing out as far as real wages are concerned.

Noah notes but doesn't expand much - and it is actually important, imho - that, if this was true, the 'sticky wages' aspect of Market Monetarism and the idea that inflation would allow for a lowering of real wages and thus increase employment, is debunked.

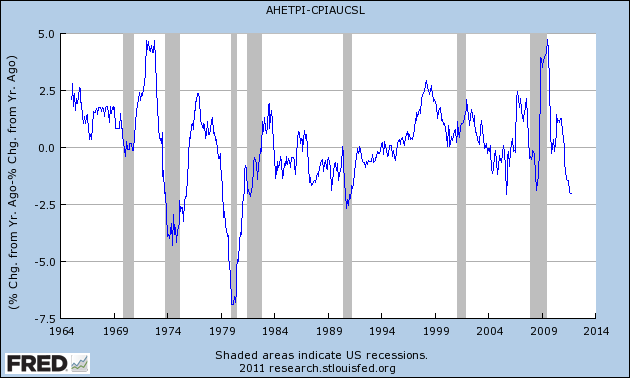

Now, Noah does post a graph that seems to show wages and CPI tracking each others pretty well. And I've got another one, which I think is cleaner/better, saying more or less the same thing.

But I do have a problem relating this graph (or Noah's) with not only my everyday experiences ("the plural of anecdotes is not data", I know) but also with graphs like those ones:

Basically, despite Noah's claims to the contrary and even the research he is quoting, I am rather unwilling to revise my prior that Labour has been getting the short end of the stick.

Not only is Labour share of GDP going down, not only are real wages stagnating compared to productivity gains but unemployment and underemployment remain high and rates of participation to the labour force are going down beyond what demographics ought to imply.

In this context, with no unions left to barter collectively or ability of individuals to negotiate on their own behalf, I am highly suspicious of the belief that mild inflation would translate into nominal salary growth and thus preserve whatever real wages people are getting.

But this is more than just a debate about whether Noah and the researchers he quoted are correct on this point. I doubt it but I could very well be wrong.

In my opinion, the killing blow to the argument for mild inflation is that most of the benefits Noah identifies could be had... if the USA had a bit more political will/a functioning Congress.

Since 2008, I have been an advocate of reducing the debt load on people. My favourite scheme, in order to avoid the "it's unfair to help those who were not careful" criticisms debt forgiveness always attracts, would be to give $20,000 to every citizens above 18. And they could do with this money as they please... unless they have debts. In which case, those $20,000 are prioritise to closing down or reducing the debt load. Any left-over (if you had debt of $15,000, say, and are thus left with $5,000) are for you to do with as you please, yet again.

Estimated costs are: 225 millions (US citizens above 18) times $20,000 i.e. $4.5 trillions, if I didn't mess up my exponents. Not exactly cheap, of course but the various QEs, iirc, amount to $2.5 trillions to date.

Another benefit of inflation listed by Noah is the reduction of the federal debt load.

Here, I think that closing the loopholes, tax-favourable deductions and, generally, raising taxes on the richest/on international corporations might be enough.

Bringing corporate tax income back towards 4% of GDP would represent (assuming the US GDP is $16.5 trillions) $330 billions per year (again, someone should check I got the exponents right).

And, of course, the Bush Tax Cuts were estimated to have cost nearly $1.5 trillions in lost revenues...

NB: I deliberately ignore potential negatives on raising corporate tax rates/eliminating the Bush Tax Cuts (as I believe the negatives ought to be small, given that they privilege the top 1% of earners most) but do note that I also ignore the potential positives of reducing personal debt/giving people some extra spending power (and I believe that those ought to be fairly large)

So, in conclusion, I still dislike the idea of using inflation as a way to solve our debt issues. Inflation remains the silent thief. Making it the silent Robin Hood does not particularly entice it to me. I would prefer direct forgiveness, direct re-distributive taxation and honest-to-God debates on the pros and cons of these solutions.

We're in this together, God-dammit. What does it say about us, as a society, that we need to resort to accounting fraud and monetary slight-of-hand because we cannot convince people, even the rich, that they'd better off in a country/system where wealth is spread-out?

Not only is Labour share of GDP going down, not only are real wages stagnating compared to productivity gains but unemployment and underemployment remain high and rates of participation to the labour force are going down beyond what demographics ought to imply.

In this context, with no unions left to barter collectively or ability of individuals to negotiate on their own behalf, I am highly suspicious of the belief that mild inflation would translate into nominal salary growth and thus preserve whatever real wages people are getting.

But this is more than just a debate about whether Noah and the researchers he quoted are correct on this point. I doubt it but I could very well be wrong.

In my opinion, the killing blow to the argument for mild inflation is that most of the benefits Noah identifies could be had... if the USA had a bit more political will/a functioning Congress.

Since 2008, I have been an advocate of reducing the debt load on people. My favourite scheme, in order to avoid the "it's unfair to help those who were not careful" criticisms debt forgiveness always attracts, would be to give $20,000 to every citizens above 18. And they could do with this money as they please... unless they have debts. In which case, those $20,000 are prioritise to closing down or reducing the debt load. Any left-over (if you had debt of $15,000, say, and are thus left with $5,000) are for you to do with as you please, yet again.

Estimated costs are: 225 millions (US citizens above 18) times $20,000 i.e. $4.5 trillions, if I didn't mess up my exponents. Not exactly cheap, of course but the various QEs, iirc, amount to $2.5 trillions to date.

Another benefit of inflation listed by Noah is the reduction of the federal debt load.

Here, I think that closing the loopholes, tax-favourable deductions and, generally, raising taxes on the richest/on international corporations might be enough.

Bringing corporate tax income back towards 4% of GDP would represent (assuming the US GDP is $16.5 trillions) $330 billions per year (again, someone should check I got the exponents right).

And, of course, the Bush Tax Cuts were estimated to have cost nearly $1.5 trillions in lost revenues...

NB: I deliberately ignore potential negatives on raising corporate tax rates/eliminating the Bush Tax Cuts (as I believe the negatives ought to be small, given that they privilege the top 1% of earners most) but do note that I also ignore the potential positives of reducing personal debt/giving people some extra spending power (and I believe that those ought to be fairly large)

So, in conclusion, I still dislike the idea of using inflation as a way to solve our debt issues. Inflation remains the silent thief. Making it the silent Robin Hood does not particularly entice it to me. I would prefer direct forgiveness, direct re-distributive taxation and honest-to-God debates on the pros and cons of these solutions.

We're in this together, God-dammit. What does it say about us, as a society, that we need to resort to accounting fraud and monetary slight-of-hand because we cannot convince people, even the rich, that they'd better off in a country/system where wealth is spread-out?

Good post. Noah has his head up his arse on most issues. Hes just shilling for the status quo.

ReplyDeleteThanks for the 'Good post' comment, it means a lot to me, a non-eco professor, that people think I am not talking entirely out of my arse.

DeleteHowever, I can't agree with your evaluation of Noah Smith. I think he is thoughtful, in general and, maybe, quite careful about expressing himself too vigorously because there is so much we don't really know about how the real world works

That might come across as 'shilling for the status quo' but I would say that being prudent about one's opinions is definitely not 'having one's head up one's arse'...